TSP Allocation Considerations

Let’s take another look at how you should and should NOT allocate from the perspective of the TSP Lifecycle funds. The TSP administrators are making changes to the Lifecycle funds and the Thrift Savings Plan website provides graphs reflecting these changes.

The Lifecycle funds are leaning more toward equities and away from the safe funds. They tell us this has become the industry standard and that is true. Whether it is the right decision is up for debate.

But first we need to talk about what diversification versus allocating means. Some consider these separate concepts where diversification happens within one financial asset class – SP500 index funds (TSP C fund) are diversified since they own around 500 companies instead of two or three. The TSP F fund is “diversified” in US bonds to include corporate bonds, mortgage-backed securities and US Treasuries.

Allocating would be considered buying a diversified stock fund, a diversified bond fund, and also a diversified international stock and/or bond fund. Allocating this way is also diversification in my view, but you may see it presented differently.

One good point this brings up is all the TSP funds are already diversified within their asset class. And so the portfolio theory of allocating comes along and says we invest in different asset classes that reduce the overall volatility of your returns further.

Volatility?

Volatility is a key word here. Most consider the volatility of a portfolio to equal RISK. I do not like this concept. If a portfolio trends slow and steady it would be considered less risky than one that has large ups and downs. It does not matter that the slow and steady one continuously trends down, while the volatile one moves steadily higher. The worse performing portfolio would still be considered less risky if it was more stable.

The Lifecycle funds adhere to this line of thinking along with most investment marketing in the private sector. They do not consider my definition of market risk – the risk of significant market losses – in their allocation decisions. It is true the more volatile funds can sustain significant market losses, but volatility does not equate to risk in terms of where your nest egg ends up in the end.

Lifecycle funds are buy and hold funds that considers market risk static but move out of “risky” equities about 5 years prior to your retirement… just in case. While the reduce volatility over time, they do not miss significant losses and they also reduce gains in bull markets. Consider the real world…

How did this buy & hold play out in the portion invested in Europe via the TSP I fund?

I see 22 years of extreme volatility but in long sideways action going really nowhere.

I bring this up, because any short term look (under 10 years) in the rear view mirror is impressive in stock funds…and in the bond market in the long run (40 years).While I say the market went nowhere, do you really want to ride those down roller coasters called bear markets that lost 60% twice in Europe and over 50% twice in the US in the last 20 years. The Lifecycle funds do and hope the market is near a high when your reach retirement and not near a low.

“Look-at-those-past-returns” marketing of stocks and bonds is mainstream. But you can not repeat a 15% drop in short term interest rates since the 1980s nor its effect on the stock market and all financial asset prices including houses. We are closing in on zero interest rates today.

The TSP F fund is more straight forward to analyse than the equity funds. The TSP F fund invests in a US Aggregate Bond index that holds a cross section of all investment grade US bonds to include US Treasuries.

At the TSP F fund’s inception, its yield was much higher. Looking in the rear view mirror those historical TSP F fund returns had significant capital gains from the steady drop in US interest rates since the early 80s (a bond bull market). But now all you get is a lousy 1.22% yield.

It only takes 0.25% rise in interest rates to wipe that annual 1.22% yield out via capital losses.

The gig is up.

The secular bond market topped but was extended by the Federal Reserve suppressing of interest rates below inflation. Now the danger comes and the central banks are stuck in their distortions. But let’s stick to the analysis of past returns for now.

Folks, a 1.22% yield means a 1.22% yield. The rule-of-thumb is that the yield is also your total annualized return for the average duration of the fund (5.7 years). So expect 1.22% total returns annualized for the next 5 – 6 years. If the yield drops to 0% next year, you will receive 7% in capital gains then no yield and your average yield for the next 6 years is still close to 1.22%.

At inception, before capital gains or losses you were receiving over 8% in yield alone… annually. So past returns are worthless when evaluating future returns of fixed income. Yet that is what you will see reported in historical returns.

To get an 8% return on the TSP F fund today, the Fed would have to suppress interest rates through money printing to force interest rates negative in the US -negative! They certainly could do that but this would destroy the global financial system along the way… if they have not already.

And this is all before taking into account the growing risk of defaults on the 30% in corporate bonds and who knows what will happen to the US backed mortgage securities in the F fund. Sometime in the near future, the ability of corporations to cover their debt and produce future profits will matter again.

Stocks are more complicated, but in general the higher their valuations the lower their long-term future returns will be. We are seeing future corporate cash flow damaged while prices are pushing higher. There will be a reckoning with fundamentals in the next few years.

More on this later since it affects all the individual funds the Lifecycle Funds and their buy and hold strategy.

TSP Lifecycle Funds

The TSP.GOV website has a new look and new graphics, some graphics are useless and some are helpful. This is one of the better ones for discussing the Lifecycle Funds. I overlaid the years-to-retirement to their L2060 fund’s chart. We can see how they will change allocations as you get closer to 2060 or your retirement date.

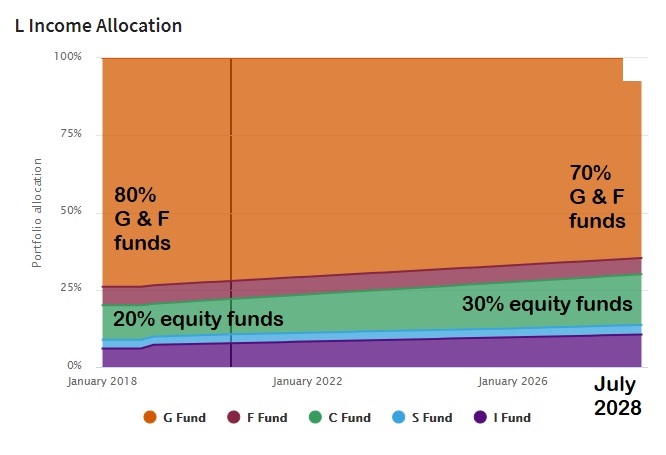

The first thing I noticed was the Lifecycle funds stay over 99% in equity funds until about 27 years out. Five years before retirement is when the funds aggressively move out of equities and into the safe funds (G and F). But I noticed on this chart that they end up with 30% in equities at retirement. Hmmm, it used to be 20%.

The Lifecycle Income fund (retirement fund) is slowly increasing exposure to equities and will hit 30% by July 2028 based on this chart. Is this a wise move? Looking backward, yes. Looking forward, it gets complicated.

It is not just the retirement fund that is changing exposures. On the next chart I added the change in allocations to selected funds under the new guidelines. The red arrows show the increase in allocations from the old model to the new model based on years-to-retirement.

But they are not jumping to these allocations percentage, they are holding current levels of equities until intercepting the new model’s allocation levels. The L 2040 allocation corresponds to the 20 years to retirement above.

The L2030 fund will hold its level of risk (allocation to equities) until it intercepts the allocations about 5 years out from retirement in 2025.

So in effect all the TSP Life Cycle funds have become buy & hold funds with no changes in allocations for years until intercepting this more aggressive portfolio.

And they are doing it in the most expensive financial bubble history. Because, you know, it is industry standard. A growing standard, by-the-way, that helped the bull market reach these levels. Remember real Market Risk doesn’t matter in buy and hold models.

They also keep telling us “you can not time the markets”. And in the short-term I agree.

But you can look at real world and use common sense. And common sense should tell you buy and hold today comes with enormous risks. Staggering risk in my opinion.

Will diversification help? Ah, no.

Why do we diversify across funds?

The Lifecycle equity allocation is geographically diversified based on market value of the three funds (C/S/I). Geographically market weighted! Not market sector weighted as the individual funds are. This matters !

Every Lifecycle fund holds the C, S and I fund based on each indexes market value. The ratio of these 3 funds does not change from Lifecycle fund to fund. What changes is the amount invested in equity versus the amount invested in the two safer funds (F and G).

But look at the chart above. The three equity funds are all highly correlated in returns. Even the International Fund moves with the US funds. That is not providing you any Market Risk diversification. None.

What’s “Market Risk” again?

When I use the term it means the risk of significant losses to your retirement nest egg which is different from what you normally hear. In 1970s portfolio theory and marketing to this day, it often means simply the volatility of your portfolio which is why they add in some less volatile bond funds and call that risk reduction.

Once upon a time, a long, long time ago in the 1970s when portfolio theory became the thing, the US and the rest of the world’s economies and stock markets did NOT move together. And Treasury yields significantly beat inflation. Diversification cross asset classes and geographically worked better then. But not today. Yet here they are pushing these ancient models on investors.

Why?

Well, they are easy and cheap to administer. Computers do all the work and financial companies collect all the fees – yes, much lower fees today, but still easy fees. Not to mention these firms have perfect insider information on what their clients are doing.

And the nice thing for wall street is these buy & hold Lifecycle investors DON’T SELL in bear markets and they take the hit while the smart money steps in & out of the markets.

Imagine if the TSP Lifecycle funds were actively managed and they tried to sell $2 trillion dollars of equities at the same time. It can not be allowed to happen because it would crash the markets. Hence keep the masses in the index funds and tell them buy & hold and they can not time the market… and throw in there “the market always comes back” (just maybe not in your investment horizon).

I will not go into depth here on sector analysis, but the Lifecycle funds reduce your exposure to the best performing companies in the world, the global IT titans, which sit only in the TSP C fund. So when the Lifecycle funds geographically diversify into the I fund, they are under-allocating you to global tech and communication services.

Safe funds provide portfolio diversification ?

So what does increasing “diversification” into the safe funds really provide? In my opinion the primary effect is reducing your exposure to the volatility of equities, period. Take a look.

Today’s monetary policy of financial repression has squeezed all the returns out of pension safe investments. We are still better off than Europe where pensions are being CHARGED money by the banks to hold their cash. But the TSP G funds primary benefit today is it will save your savings from the next bear market’s erasing much of the gains in the equity markets. It also offsets some of inflation effects.

And if you look at the TSP Lifecycle retirement fund you will see they lean heavily on the G fund too. They provide a token 6% to the TSP F fund but all the rest of the “safe” allocations go to the TSP G fund.

So if you are a Lifecycle fund investor you are:

- Buy and holding regardless of market valuations

- Heavily exposed to Market Risk (significant losses during bear markets)

- Underweight global tech which sits in the TSP C fund

- Underweight the effect of US corporate buybacks on market prices

- Achieve little diversification because all equity funds are highly correlated

Sure, they are easy to invest in. Set and forget. But don’t look at your balance during the next bear market. Wait 12-15 years for it to catch back up to near where it is today before peeking.

So what’s the alternative?

To go deeper into the individual funds and how to simplify your allocation decision, please look at my Best TSP Allocation Strategy which looks harder at why the US funds out performed the International fund and a discussion on the single most important decision you have to make.

The link above is free and I don’t collect emails. And you will not find jumping ads on my website. You may find grammatical errors because I just push information out and don’t produce polished marketing information. But it will help you make better allocation decisions today. And that is what really counts, isn’t it?

Invest Smart,

Michael Bond

TSP Smart & Vanguard Smart Investor serves serious and reluctant investors

Categories: Best TSP Allocation, Perspectives, TSP Allocation Strategy