I can pretty much guarantee the next financial crisis will occur within the next five years.

Wall St. banks ask Fed for five more years to comply with Volcker rule (aka. consumer protection)

Wall Street will need a bigger bailout and the central banks know it, so the central bankers are starting early with pre-crisis bailouts. Meanwhile, Bank of America’s chief explains why the US stock market keeps heading higher, “because there’s nowhere else to get returns globally with low to negative interest rates.” What he fails to mention is dividends can stop and stock prices can go to zero overnight when a company declares bankruptcy. In the meantime, bubble-on.

Think back to the housing bubble. By holding rates too low too long, the Fed certainly added fuel to the housing bubble. Baby step hikes by Alan Greenspan did not slow the bubble, they fueled it. -Mish

Reading a Mish Shedlock’s post this morning, his statement forced me to stop and reread it. If Alan Greenspan’s hikes were baby steps, what are Janet Yellen’s. We know that setting rates to zero for eight years has blown the largest global credit and derivatives bubble in history. But baby step hikes *fuel* the bubble not burst it, is a new thought.

So while initially it would seem that raising rates would pop the bubble (and almost did), once the markets realize how slow and how low the target will be much of the fear might subside and allow the bubble to continue for a while longer. The focus then becomes the 2 trillion dollar annualized pace the other central bankers have been dumping key-stroked money into the financial markets.

And that focus brings us to the fact the central banks will run out of currently eligible assets to buy in the near future which is leading to speculation as to what they will buy next (non-performing loans & stocks). The bubble levels (with ongoing corrections) will last until confidence in the current warped policies is lost. And then it will get ugly unless the central banks buy and own everything as it appears the Bank of Japan is doing. At that point, there would be no returns on capital for investors (nothing to buy) just inflation to take back purchasing power. Meanwhile, the bubble grows and the dry economic rot continues to build as banked corporate losses grow.

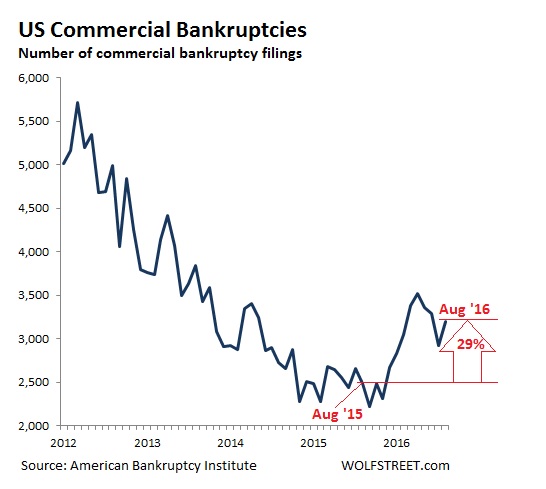

Wolf Richter in a series of posts provides us with an update on the turning of the credit cycle which the central bankers have been trying to hold back. I do not agree with Wolf’s kind assessment that the commercial loans were just for capital investment purposes. Much was for short term wealth extraction and it will be played out in overwhelmed bankruptcy courts. Think of bull markets as the banking of losses through financial engineering and bear markets as the dumping of those losses under the cover of everyone else doing it. Reset, repeat.

One would think credit spreads would be blowing out with the rising default rates – wait, they were until early in the year. The ECB’s QE venture into corporate bonds (early in the year) is driving all corporate bond interest rates and thus credit spreads down since they first announced their pre-crisis bailout tool in March of this year. As the CEO of Bank of America pointed out, this is having spill over effects in the US markets.

Most amazing in the mad monetary experiment is that in Europe BB-rated bonds are about to go *negative!!!!* and join A and BBB rated corporate bonds. Who would buy such a thing? I know why a corporation would love to sell a bond that pays itself off, but why would anyone invest in a guaranteed loss. Unless you think you could sell it at a higher price to a sucker like a pension fund or a loss insensitive buyer like a central bank that uses money printed out of thin air to cover losses. Think about it, how many houses would you try to buy if you could get a minus 2% mortgage that pays itself off in a world of run away monetary inflation. Sorry… an ECB official already came out and said this will never be allowed for consumer loans, only corporations and banks – someone has to absorb the losses.

Well at least all this new money printing and wealth transfer is leading to higher global growth…

I assume the primary reason they decided to “adjust” the global trade volume when they did, is that the rapid 4% drop from December of 2014 just looked too bad. It looks much better to only have a 2% drop and a flat looking chart than a major contraction in global trade. So how is the global engine of growth, China, doing these days. Well if you believe the minister of truth they still have positive but lower growth – although one wonders why they needed to inject a trillion dollars into their state-run banks in the first half of 2016.

At least China’s export-drive manufacturing economy is strong…

…after we transferred all our good paying non-seasonal manufacturing jobs to them since 2000.

So yes Janet Yellen you can raise interest rates now. The ECB, China and the Bank of Japan have the global financial markets covered this time and the low rates never really did anything for the economy – it just punished savers, pensions and life insurance companies and in turn slowed the economy down.

Limits do exist for what the central banks can do. It is just that no one knows exactly where those limits are, even the central banks. Those limits will be revealed once confidence is lost.

About TSP & Vanguard Smart Investor

Categories: Perspectives, The Smart Bird